Just How To Select The Right Health Insurance Prepare For You

Web Content Composed By-Kramer Hudson

Considering your current clinical requirements is essential when choosing a health insurance plan. As an example, you may want to take into consideration whether the potential strategy requires a health care medical professional and/or referrals to see experts or if the prescription drugs you take are covered.

You should also review the plan's network dimension. Some strategies have tiered networks that supply lower costs as long as you stick to recommended providers.

Expense

The expense of a medical insurance strategy affects just how much you pay regular monthly in premiums and also how much you pay out-of-pocket for care. Generally, higher-premium strategies have lower out-of-pocket prices.

Consider your existing and upcoming medical care needs when choosing a plan. For instance, if you see medical professionals consistently or take prescription drugs typically, you might want to select a plan with a bigger network. If you want a lot more flexibility to pick service providers, you can choose a Preferred Company Company (PPO) or Exclusive Service Provider Company (EPO) strategy that allows you to go to experts without a referral from your primary care doctor. These sorts of plans typically have greater premiums than HMOs.

Coverage

When picking a medical insurance strategy, it is essential to consider the level of insurance coverage that you require. Private plans are usually classified as platinum, gold, silver, as well as bronze based upon the amount of insurance coverage that they supply.

When picking a plan, ensure that it has a huge network of physicians as well as healthcare providers. Many insurance coverage providers have online devices that allow you to locate in-network doctors and health centers. Staying in- https://www.linkedin.com/company/healthpluslife will generally conserve you money on copays, deductibles, and out-of-pocket prices. It is also an excellent concept to ask friends and family for referrals. They may have insight right into customer assistance and just how easy it is to sue.

Network

During the open registration duration, you have a restricted time to choose the ideal prepare for your family members. Tightening your options is less complicated if you understand a couple of things prior to you begin looking.

Health care strategies usually have networks of physicians, health centers, laboratories, as well as various other facilities that accept use services at an affordable price for members of the health insurance. Strategies are likewise rated for high quality.

Think of your current medical demands when choosing your plan. For example, if you want to see experts without a referral, you might intend to take into consideration an EPO or PPO, which have larger networks. Likewise, if https://www.kff.org/racial-equity-and-health-policy/issue-brief/overview-of-health-coverage-and-care-for-individuals-with-limited-english-proficiency/ take prescription drugs frequently, you'll intend to get rid of strategies that don't cover them.

Versatility

Throughout open registration, you need to assess the advantages of each plan to find which ones check all packages for your health care requires. You must likewise contrast networks, premiums as well as out-of-pocket expenses.

For example, an HMO tends to have a tight network of providers. If you see a supplier outside the network, you may be accountable for all costs. An EPO and a PPO, on the other hand, will provide you extra versatility and also options when it involves seeing professionals. These strategies typically require a referral from your health care doctor, yet you will certainly have much more selections when it involves choosing medical professionals.

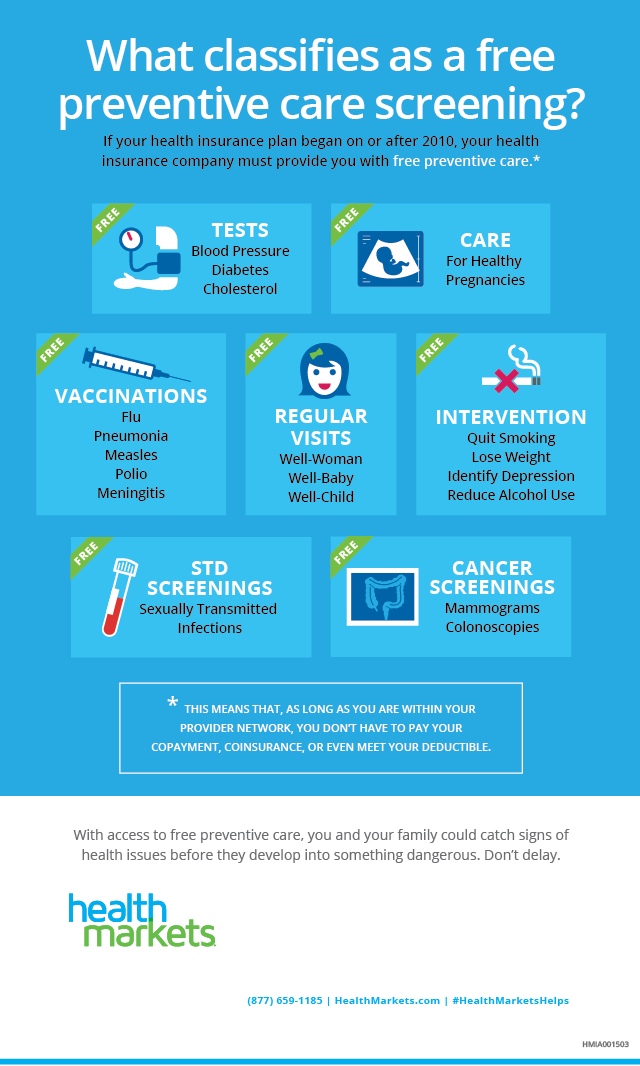

Precautionary treatment

Several health care strategies, consisting of those offered through the Industry, need to cover precautionary services without charging you a copay. These are services like routine medical and also dental appointments, evaluating tests as well as booster shots.

Preventative treatment also includes things like educating clients on healthy way of life options, motivating exercise and also suggesting dietary modifications. The goal is to assist you live a long, delighted life by determining as well as dealing with ailments prior to they end up being serious.

Consider your existing clinical needs and also any type of upcoming significant life events when choosing a strategy. This can help guarantee that your plan meets all your healthcare requirements. Additionally, think about the insurance deductible and other costs to discover the ideal equilibrium for you.

Out-of-pocket expenses

Consider how usually you expect to check out physicians as well as drug stores, as well as any other solutions you might require. Then approximate the overall yearly costs of those solutions. This includes your month-to-month premium, deductible as well as copayments (a fixed quantity for certain types of check outs or prescriptions).

Compare the approximated yearly cost of plans in various classifications to locate the very best worth. Remember that steel tiers are just based upon exactly how your strategy as well as insurance company split expenses; they do not have anything to do with the top quality of care. Strategies with low deductibles as well as high premiums tend to be extra costly. Nevertheless, they likewise require you to pay less in advance for clinical and drug store solutions.